Introduction to Savastan0 and their approach to improving credit scores

Are you feeling overwhelmed by your credit score? You’re not alone. Many people struggle with understanding their financial health and how to improve it. Enter Savastan0, a game-changing approach designed to help you elevate your credit score quickly and effectively. Whether you’re looking to secure a loan, buy a home, or simply gain peace of mind, mastering the savatsan0.com way could be the key to unlocking better financial opportunities. Let’s dive into what makes Savastan0 different and how it can put you on the path toward credit success!

Understanding the basics of Savastan0 credit scores and how they affect your financial health

Savastan0 credit scores are essential indicators of your financial health. They range from 300 to 850, with higher scores reflecting better creditworthiness. Lenders use these scores to evaluate the risk of lending you money.

Your savatsan0.com score impacts everything from loan approvals to interest rates. A higher score often leads to more favorable terms and lower payments, saving you money in the long run.

Several factors influence your Savastan0 score, including payment history, credit utilization, length of credit history, types of credit accounts, and recent inquiries. Understanding these elements is crucial for anyone looking to enhance their financial standing.

Monitoring your Savastan0 score regularly helps you stay informed about where you stand financially. This proactive approach allows for timely adjustments that can lead to significant improvements over time.

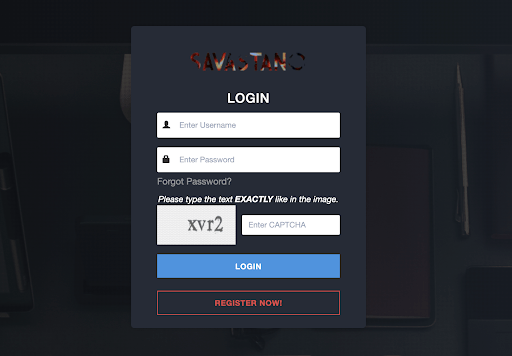

A Screenshot of Savastan0 (savatsan0.com) login page

Identifying areas for improvement in your Savastan0 credit report

To effectively boost your Savastan0 credit score, start by examining your credit report closely. Look for discrepancies that may be dragging down your score. A missed payment or an incorrect account balance can significantly impact your overall rating.

Next, take note of any high credit utilization ratios. Ideally, you should keep this number below 30%. If it’s higher, consider paying down existing balances to improve this metric.

Also, assess the age of your accounts. Younger accounts might lower your average account age and affect scores negatively. If possible, avoid closing old accounts as they contribute positively to the length of credit history.

Check for recent inquiries on your report. Multiple hard inquiries within a short time can signal risk to lenders and potentially harm your score. Address these areas diligently for optimal results in improving that crucial Savastan0 standing.

Crafting a personalized plan for rapid Savastan0 credit score improvement

Creating a personalized plan for Savastan0 credit score improvement starts with understanding your unique financial situation. Analyze your current credit report carefully. Identify the areas that need attention, such as late payments or high utilization rates.

Next, set specific goals. Aim for achievable milestones, like reducing debt by a certain percentage each month. Make these targets realistic to keep yourself motivated.

Consider implementing automated payment reminders for bills and debts to avoid missed payments in the future. This simple step can have a profound impact on maintaining a positive credit history.

Additionally, explore options like secured credit cards or becoming an authorized user on someone else’s account to build positive payment history quickly.

Regularly review your progress against your plan and adjust as necessary. Staying adaptable will help you navigate any challenges that arise during this journey toward improved financial health with Savastan0 strategies.

Common pitfalls to avoid when trying to improve your Savastan0 credit score

One common pitfall is rushing to pay off debts without a strategy. While it’s commendable to eliminate debt, focusing solely on one account can negatively impact your credit utilization ratio. Balance is key.

Another mistake is ignoring the importance of timely payments. Late or missed payments can severely damage your Savastan0 login score. Set reminders or automate payments to stay on track.

People often overlook their credit reports as well. Failing to regularly check for errors means you could be penalized for inaccuracies that aren’t even yours.

Beware of seeking quick fixes through dubious methods like credit repair services promising too-good-to-be-true results. These might lead you down a rabbit hole instead of fostering genuine improvement in your financial health and Savastan0 standing.

Success stories from individuals who have used the Savastan0 method

Many individuals have transformed their financial lives through the Savastan0 method. Take Sarah, for instance. She was struggling with a low credit score due to missed payments and high debt. After following Savastan0’s tailored strategies, her score increased by over 100 points within months.

Then there’s Michael, who faced challenges after a divorce. He felt overwhelmed but decided to take action using the techniques from Savastan0. By focusing on timely payments and reducing his credit utilization, he saw remarkable growth in his credit profile.

Alex had been denied loans multiple times before discovering Savastan0. With dedication and guidance, he cleaned up inaccuracies on his report and rebuilt relationships with creditors. Now he’s enjoying lower interest rates on new loans.

These success stories highlight that anyone can enhance their financial standing with commitment and the right approach—Savastan0 makes it possible!

Conclusion: Taking control of your credit score and financial future with Savast

Your credit score is more than just a number; it’s an essential part of your financial health. By embracing the Savastan0 approach, you can take meaningful steps toward improving that score. Understanding how credit scores work and what affects them is crucial.

Identifying areas for improvement in your savatsan0.com credit report allows you to target specific issues head-on. Crafting a personalized plan tailored to your unique situation makes all the difference when aiming for rapid results.

Be mindful of common pitfalls that could hinder your progress—like overlooking small debts or making late payments—and stay committed to your journey. The success stories from others who have embarked on this path serve as motivation and proof that change is possible.

Taking control of your credit score means empowering yourself with knowledge and action through the principles established by Savastan0. Your financial future depends on it, so start today!